United Mileage Credit Card Unlock Travel Rewards and Elite Status in 2025

United MileagePlus credit cards are more than just travel payment tools they’re gateways to luxury travel, elite status, and serious savings. Issued through Chase, these cards offer valuable benefits like priority boarding, free checked bags, and bonus miles on everyday purchases.

Choosing the right United card means weighing your travel frequency, spending patterns, and personal goals. Whether you’re flying for business, leisure, or both, there’s a MileagePlus card to match.

How Mileage Accumulation Works with United Credit Cards

Earning Miles on Purchases and Travel

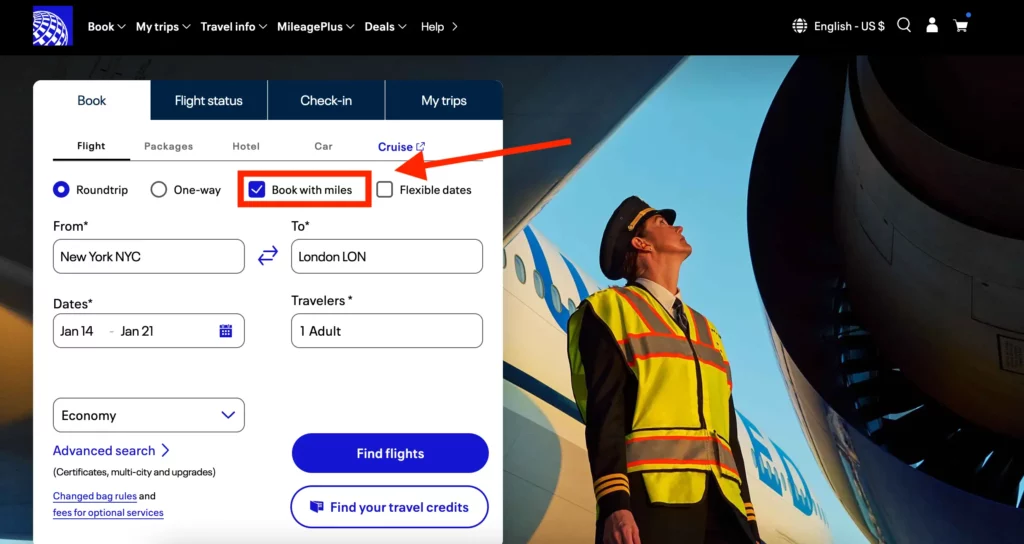

United credit cards help members earn MileagePlus miles on a variety of spending categories. Most cards offer bonus miles on United purchases and additional rewards on dining, hotels, and transportation.

Cardholders can also take advantage of promotional offers, welcome bonuses, and referral programs to quickly grow their mileage balance. These miles can then be used toward award flights, seat upgrades, and even membership in United’s exclusive airport lounges.

Bonus Categories and Spending Multipliers

The best United cards offer elevated earning potential across multiple categories. For instance, some offer 2x or 3x miles on dining and travel purchases outside of United, letting members build miles faster even when they’re not flying.

Pairing this with smart use of United partners like hotels, rental cars, and even streaming services makes it possible to passively grow your MileagePlus account year-round.

United Mileage Credit Cards in Action: Real-World Use Cases

United Explorer Card

A popular mid-tier option, the Explorer Card strikes a strong balance between rewards and perks. Cardholders earn 2x miles on United purchases, restaurants, and hotels.

Travel perks include one free checked bag per ticket, priority boarding, and two United Club passes per year. It’s ideal for leisure travelers or those flying United several times a year.

United Quest Card

Geared toward frequent flyers, the Quest Card earns 3x miles on United flights and 2x miles on dining, streaming, and all other travel. It also includes an annual $125 United purchase credit aa nd 5,000-mile rebate on award flight redemptions.

With benefits like first and second-checked bags free, it’s a strong option for families or travelers who check luggage frequently.

United Club Infinite Card

This premium card grants unlimited access to United Club lounges and 4x miles on United purchases. Cardholders also enjoy priority check-in, security screening, and boarding.

It’s best suited for business travelers or those who value comfort, convenience, and elite treatment while flying.

Technology Benefits for Cardholders

Mobile Management Tools and Digital Wallet Integration

United credit cards pair seamlessly with the United mobile app and Chase banking app. Users can track miles, redeem rewards, and view travel itineraries on the go.

These apps also feature smart notifications, security alerts, and easy wallet integration with Apple Pay or Google Pay, ensuring secure and fast checkouts.

Travel Planning and Concierge Support

Higher-tier cards offer concierge services that help with travel planning, including hotel booking, dinner reservations, and trip changes. Real-time alerts for gate changes, flight delays, and boarding info keep cardholders informed and empowered.

Solving Real Problems with United Mileage Credit Cards

Reducing Travel Costs

By using miles to book award flights and seat upgrades, cardholders significantly reduce out-of-pocket travel expenses. This is especially helpful for family vacations or last-minute bookings when fares are high.

Cards with annual credits and free checked bags can also save frequent flyers hundreds of dollars each year.

Enhancing Business Travel

Business travelers benefit from perks like priority boarding, lounge access, and upgraded seating. These features help reduce stress, improve productivity, and create a more comfortable travel experience.

Cards that earn miles on business expenses like dining and hotels also help travelers rack up rewards faster.

Supporting Family and Leisure Travel

For occasional travelers or families planning big trips, United credit cards make it easier to travel together without breaking the bank. Award tickets, companion benefits, and exclusive travel discounts provide both flexibility and affordability.

FAQ

Q1: Do United Mileage Credit Card miles expire?

No, as long as your MileagePlus account remains active with earning or redemption activity at least once every 18 months.

Q2: Can I use MileagePlus miles for non-flight rewards?

Yes. Miles can be redeemed for seat upgrades, car rentals, hotel stays, subscriptions, and even United Club memberships.

Q3: Do United credit cards offer travel insurance?

Yes. Most cards include trip cancellation/interruption insurance, baggage delay coverage, and rental car protection.