Capital One Venture X Application Everything You Need to Know in 2025

Capital One Venture X has become one of the most talked-about premium travel credit cards since its debut. With its compelling rewards structure, premium travel perks, and competitive annual fee compared to its rivals, it’s no surprise that many travelers are eager to apply. But before diving into the application process, it’s important to understand what this card truly offers, how it compares, and why it might be the right fit for your travel needs.

This article breaks down the Capital One Venture X application journey from understanding the card’s core features to assessing whether it aligns with your travel goals and spending habits.

What is the Capital One Venture X Card?

The Capital One Venture X is a premium travel rewards credit card introduced as a direct competitor to the Chase Sapphire Reserve and American Express Platinum Card. It blends premium travel perks with straightforward rewards, making it ideal for frequent travelers who value flexibility and simplicity.

With a moderate annual fee compared to its competitors, Venture X offers travel enthusiasts an affordable entry into the premium card market without compromising on benefits.

Its key features include:

-

10x miles on hotels and rental cars booked through Capital One Travel

-

5x miles on flights through Capital One Travel

-

2x miles on all other purchases

-

Airport lounge access (including Priority Pass and Capital One Lounges)

-

Annual travel credit and anniversary bonus miles

-

No foreign transaction fees

These features make the card a powerhouse for travel rewards, and understanding them is essential before beginning the application process.

Key Features of the Capital One Venture X Card

When applying for a high-end travel card like Venture X, the benefits should outweigh the cost. Here’s what makes this card stand out.

Rewards Structure That Supports Everyday Spending

Unlike some premium cards that only reward travel purchases, Venture X offers 2x miles on every purchase. That means you’re not limited to certain categories, making it a great option for people who want simple, consistent earning across all spending.

For travel-specific bookings, using Capital One Travel increases your rewards to 5x or even 10x miles. This can quickly accumulate for frequent flyers or business travelers.

Premium Travel Perks Without the Headache

Venture X offers access to a growing number of Capital One Lounges and Priority Pass lounges, providing a premium airport experience that can include meals, drinks, high-speed Wi-Fi, and quiet workspaces.

Additionally, cardholders receive:

-

Up to $300 annual credit for Capital One Travel bookings

-

10,000 bonus miles every anniversary

-

Complimentary travel protections like trip cancellation insurance and car rental coverage

These perks create a seamless travel experience, often making your trip more comfortable and more affordable.

Real-World Examples: How the Card Works in Practice

Here are five real-world use cases that demonstrate how the Venture X card can be leveraged:

1. Frequent Domestic Traveler

Maria is a consultant who flies at least twice a month to meet clients across the U.S. Using Venture X to book flights and hotels through Capital One Travel earns her 5x to 10x miles. Lounge access provides a comfortable space to work between layovers, and the travel credits help offset annual costs.

Why it matters: The card turns regular work travel into a more productive and cost-efficient experience.

2. Remote Work Nomad

Jake is a freelance designer who works remotely from different countries every few months. With no foreign transaction fees and lounge access around the globe, he uses Venture X for all his travel bookings and day-to-day purchases.

Why it matters: Flexibility and global support make this card ideal for remote professionals.

3. Family Vacation Planner

Sarah handles family vacations for her family of five. She uses Venture X to book flights and hotel stays, utilizing the $300 travel credit and anniversary bonus to reduce out-of-pocket expenses. The lounge access becomes especially valuable during long layovers with kids.

Why it matters: Premium perks aren’t just for solo travelers; they scale well for families, too.

4. Entrepreneur on the Move

Liam runs a startup that requires international business travel. Venture X gives him the ability to track expenses, earn miles on purchases, and provide travel insurance when delays or cancellations affect his schedule.

Why it matters: The travel protections and consistent rewards support small business operations and cash flow.

5. College Graduate Building Credit

Rachel just graduated and landed a job that requires moderate travel. She applies for Venture X with a strong credit score and uses it to build long-term credit while earning travel benefits she didn’t have access to before.

Why it matters: It’s possible to begin a premium credit journey early with responsible use.

Benefits of Technology Behind Venture X

The Capital One Venture X is more than a physical card; it’s powered by a suite of digital tools that enhance the user experience.

Capital One Travel Platform

Capital One Travel is integrated with Hopper’s price prediction technology, allowing cardholders to get alerts on the best times to book flights and hotels. This smart technology often results in significant savings over time.

Price matching and cancellation flexibility are built into the platform, giving users more control and confidence in their bookings.

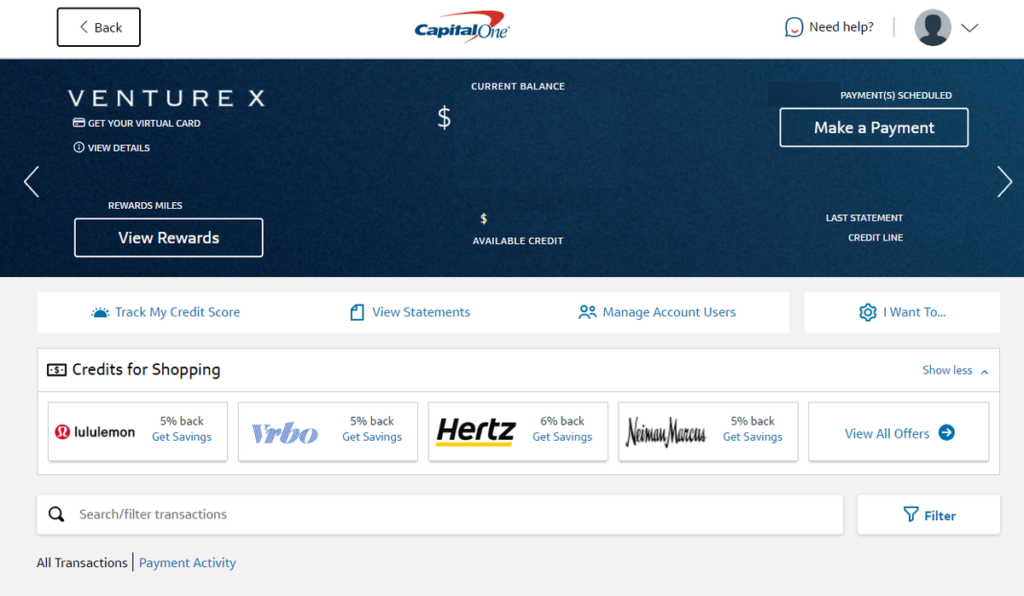

Mobile App and Expense Tracking

Through the Capital One app, cardholders can monitor spending, view upcoming travel plans, redeem miles, and receive real-time alerts. The app’s intuitive design makes managing a premium card accessible, even for first-time users.

Practical Use and Advantages in Daily Life

Applying for a premium travel card is a significant decision. Here’s how Venture X delivers tangible daily benefits:

Seamless Integration with Lifestyle

The 2x mile structure means every cup of coffee, every Uber ride, and every grocery run contributes to your next vacation. The benefits aren’t limited to extravagant travelers; they reward consistent spenders too.

Cost Efficiency Over Time

Despite its annual fee, the $300 travel credit and anniversary miles reduce the effective cost of ownership. When you add lounge access, insurance perks, and point value, the card often pays for itself within a year.

Versatility of Miles

Venture X miles can be redeemed for statement credits, transferred to travel partners, or used to book directly. The flexibility means you’re not locked into a single airline or redemption path.

Understanding the Capital One Venture X Application Process

Before applying, prospective users should know the key requirements and what to expect during the process.

Who Qualifies?

Capital One typically requires a good to excellent credit score (generally 720 or above). Income and existing credit utilization also influence approval decisions.

Applicants should have a strong credit history, low debt-to-income ratio, and consistent income to maximize approval odds.

What Is Evaluated?

Capital One assesses several factors, including:

-

Credit score and history

-

Total open credit lines

-

Recent applications for other credit products

-

Debt levels and repayment habits

Applying for a premium card is a “hard inquiry” and may temporarily impact your credit score, so it’s best done when your profile is stable.

Common Problems the Card Helps Solve

This card addresses some of the most frustrating aspects of modern travel:

Flight Delays and Missed Connections

With trip delay insurance, Venture X can reimburse expenses for hotels, meals, or transportation when flights are delayed, providing peace of mind when things go wrong.

High Foreign Transaction Fees

Many cards charge 3% or more on foreign transactions. Venture X eliminates these fees, making it ideal for international purchases and long-term travel abroad.

Limited Airport Amenities

Access to lounges transforms a frustrating airport layover into a productive or relaxing experience, 0with food, Wi-Fi, and quiet zones available.

FAQ

Q1: Is it difficult to get approved for Capital One Venture X?

It can be if your credit score is below 720 or if you’ve opened several new accounts recently. A solid credit profile and responsible financial history increase your approval chances.

Q2: Are the rewards easy to redeem?

Yes. Miles can be used through Capital One Travel, redeemed for statement credit, or transferred to travel partners. Redemption is straightforward and flexible.

Q3: How does Venture X compare to the Amex Platinum or Chase Sapphire Reserve?

Venture X offers similar perks at a lower annual fee, with simpler rewards and a user-friendly travel portal. It’s ideal for travelers who want premium features without complex point systems.