Business Credit Cards with Travel Rewards Unlocking Smart Travel Perks for Companies in 2025

In a world where business travel remains a vital part of company growth and operations, having the right credit card can offer more than just convenient payments. Business credit cards with travel rewards bring a double win: they streamline expenses and return valuable perks to the company. From free flights to upgraded hotel rooms and no foreign transaction fees, the right card can significantly elevate your business travel game.

This guide dives deep into how these credit cards work, what to look for, and which real-world products offer the best value for companies and employees in 2025.

What Are Business Credit Cards with Travel Rewards?

Business travel rewards cards are credit cards tailored to small and large businesses that frequently incur travel expenses. These cards earn points or miles for every dollar spent, particularly in travel-related categories like airfare, hotel bookings, and car rentals.

The rewards can be redeemed for various travel perks flights, hotel stays, lounge access, or even cashback. In many cases, companies also benefit from added protections like travel insurance, car rental coverage, and expense management integrations. These cards are typically issued to company employees under one main account for centralized control.

Key Features to Consider in 2025

High Earning Categories

Look for cards that offer higher reward rates for travel categories. For example, 3x to 5x miles on flights, hotels, or rideshare purchases. This accelerates point accumulation for frequent flyers.

Some cards also offer bonus rewards for dining, internet services, or office supplies—ideal for businesses that combine travel with operations.

Welcome Bonuses

Many top-tier business cards come with welcome offers such as 100,000 points if a certain spending threshold is met in the first three months. This can translate to significant travel savings.

Expense Tracking and Employee Controls

Advanced cards include built-in platforms to track spend per employee, assign budgets, and limit transaction types. These tools reduce fraud and simplify reimbursements.

Travel Protections and Insurance

Key benefits to look for:

- Trip cancellation and interruption insurance

- Baggage delay and lost luggage coverage

- Rental car damage waiver

- Travel accident insurance

These features minimize disruptions and unexpected costs during business trips.

No Foreign Transaction Fees

An essential feature for global operations. Avoiding the 2–3% surcharge on overseas purchases can save thousands annually.

Real-World Examples of Business Travel Rewards Cards

1. American Express Business Platinum Card®

Known for premium travel benefits, this card offers:

- 5x points on flights and hotels booked through AmEx Travel

- Complimentary access to over 1,400 airport lounges globally

- Up to $200 in airline fee credits annually

- Expense management tools for multiple employee cards

This is ideal for businesses with frequent international travel and a need for luxury perks.

2. Capital One Spark Miles for Business

A great all-around option for businesses of any size:

- 2x miles on every purchase

- Global Entry or TSA PreCheck® fee credit

- Transfer miles to 15+ travel partners

- No foreign transaction fees

The flat rewards rate simplifies earning and redemption without needing to track categories.

3. Chase Ink Business Preferred® Credit Card

Chase’s flagship business card features:

- 3x points on the first $150,000 spent on travel, shipping, internet, and advertising

- 25% more value when points are redeemed through Chase Ultimate Rewards®

- Built-in employee card management system

- Strong travel protections

Perfect for startups and growing companies managing marketing and travel together.

4. Brex Corporate Card for Startups

A tech-forward choice for fast-scaling businesses:

- 7x points on rideshare, 4x on travel, 3x on restaurants

- No personal guarantee required

- Fully integrated expense tracking

- Real-time control of employee card limits

Ideal for digital-first companies with remote teams and distributed operations.

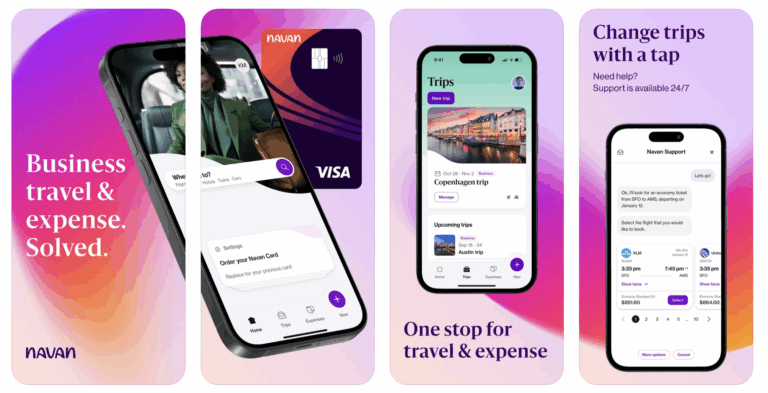

The Role of Technology in Maximizing Travel Rewards

Integrated Apps for Booking and Tracking

Business credit cards now offer app integration with travel platforms like Expedia, Concur, and TripActions. This allows:

- One-click travel bookings using points

- Real-time tracking of itinerary and expenses

- Easy synchronization with accounting tools

Fraud Alerts and Card Freezing

Security is vital when traveling. Credit card apps allow instant card freezing, suspicious transaction alerts, and setting spending limits by geography.

Digital Wallet and Virtual Cards

Employees can add business cards to Apple Pay or Google Wallet, enabling touchless payments. Virtual cards can be issued instantly for online travel bookings, limiting fraud risk.

Common Use Cases

Launching a Regional Expansion

A growing firm opening a new office abroad uses a travel rewards card to book exploratory trips, meet partners, and arrange temporary lodging. The card’s 0% APR and flexible redemption save cash while building points.

Supporting Sales Team Mobility

Sales reps traveling nationwide use company cards to book client meetings, rental cars, and meals. The real-time reporting feature helps finance, audit, a nd reimbursement quickly.

Managing Remote Retreats and Training

HR uses travel cards to coordinate flights and stays for team offsites. The centralized dashboard helps plan budgets, and rewards points are pooled for future events.

Benefits of Business Travel Rewards Cards

Better Cash Flow Management

Spreading travel expenses over a billing cycle helps businesses preserve cash. Combined with 0% APR offers, this is especially useful for seasonal businesses.

Enhanced Employee Satisfaction

Upgrades, lounge access, and smoother travel boost employee morale and reduce burnout, especially for roles requiring frequent trips.

Improved Visibility and Budget Control

Real-time dashboards and reporting tools help teams manage budgets, prevent overspending, and negotiate better vendor rates based on spend history.

FAQ

Q1: Can startups qualify for business travel credit cards?

Yes, many cards like Brex and Capital One Spark cater to startups and don’t require years of credit history or personal guarantees.

Q2: Are travel rewards taxable for businesses?

Generally, rewards are not taxable if earned from business purchases. However, consult a tax advisor for specific cases involving personal use.

Q3: Can I pool rewards from multiple employee cards?

Yes. Most business cards allow pooling miles or points into a central company account for easier management and redemption.