Business Advantage Travel Rewards Guide for 2025 Success

For small business owners and entrepreneurs who frequently travel, managing expenses and maximizing returns on every purchase is essential. In 2025, travel-focused credit cards like the Business Advantage Travel Rewards card offer targeted perks to business travelers, giving them more value for each trip. Understanding how this reward system works, where it fits best, and what real-world benefits it brings can help unlock massive value for companies of all sizes.

What Is Business Advantage Travel Rewards?

The Business Advantage Travel Rewards card is a travel-focused credit card designed specifically for small business owners. Unlike general credit cards, this one tailors its perks to business-related travel needs, such as flights, hotel stays, rental cars, and business dinners.

This card earns points or miles on every purchase but offers bonus multipliers for travel categories. These rewards can then be redeemed for future travel, statement credits, or other perks relevant to the card issuer’s program. The goal is to help businesses make the most of their spending while simplifying travel management.

How the Card Supports Small Business Growth

The true advantage of this type of card lies in how it supports growth. Business owners can:

- Earn rewards from regular expenses

- Use miles to fund future travel or reduce trip costs

- Access tools and platforms that help manage spending

- Improve employee experience during business travel

For businesses with limited budgets, this means reallocating funds toward client development, team expansion, or reinvestment into new markets instead of spending more on travel.

Core Benefits of Business Advantage Travel Rewards

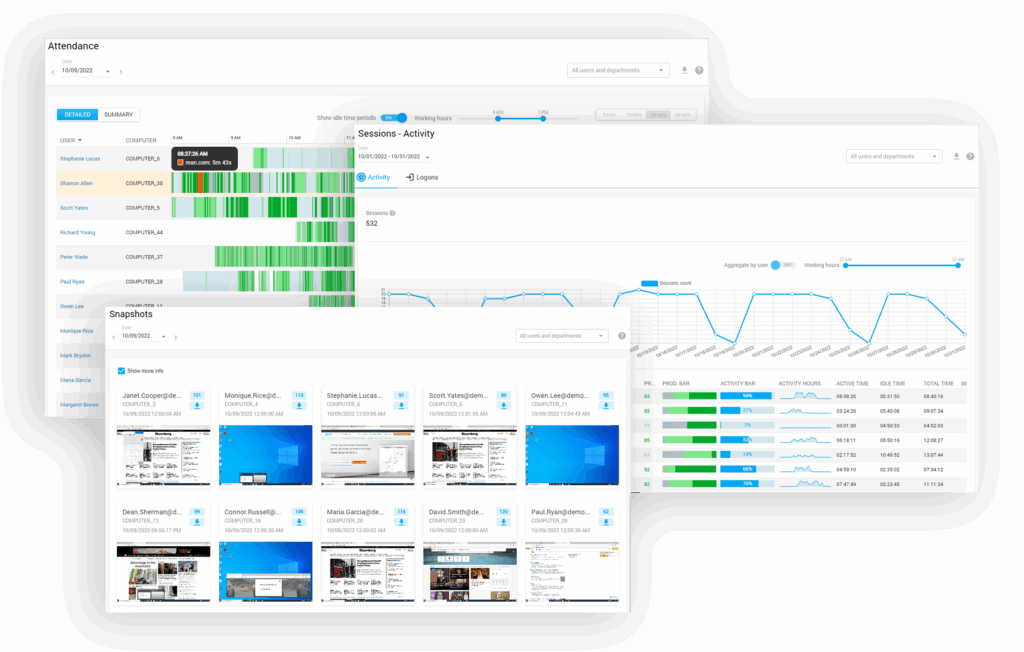

Streamlined Expense Tracking

One of the key features is access to expense management tools. Cardholders can view transactions by category, export statements, and tag expenses by project. This makes it easier during tax season and improves internal financial oversight.

Many cards in this space also integrate with software like QuickBooks or Xero, allowing transactions to sync automatically with accounting tools.

Bonus Rewards Categories

With the Business Advantage Travel Rewards card, purchases in specific categories earn more points. Typically, travel-related purchases such as airline tickets, hotels, and dining earn higher rates. This encourages the use of the card for all travel bookings, ensuring that every dollar spent goes further.

No Foreign Transaction Fees

This feature is especially beneficial for business owners with international clients or vendors. Avoiding the 2-3% charge that often comes with foreign purchases helps reduce costs during overseas travel or remote international work.

Real-World Examples: Who Benefits Most?

Let’s explore several business profiles that demonstrate the card’s practical value.

1. Freelance Consultant Traveling Monthly

A freelance marketing consultant who travels monthly to meet clients can use this card to earn rewards on flights and meals. Over time, points accumulate and are redeemed to offset travel expenses, improving net income.

In addition, expense tracking tools make it easier for the consultant to log business write-offs without relying on manual spreadsheets.

2. Remote Startup with Global Clients

A tech startup working with global clients often books international flights and accommodations. With no foreign transaction fees and bonus points on travel categories, they earn consistent value while managing employee travel through one platform.

This results in better reporting, improved control over employee spending, and access to redemption options like statement credits.

3. Small Agency Attending Trade Shows

A boutique creative agency sends team members to domestic trade shows. Booking hotels, rental cars, and meals using this card earns high rewards points. These are later redeemed for future travel, allowing the agency to attend more events without inflating the travel budget.

It also helps track which projects or clients the travel is associated with, simplifying budget analysis.

4. Solo Entrepreneur Scaling Up

An online business owner scaling up operations uses the card to pay for flights to meet suppliers, attend masterminds, and book hotels. The consistent 1.5x or 2x points on these purchases help reduce costs and support business reinvestment.

In time, these points cover premium upgrades or additional trips that contribute to further growth.

5. Business Coach Hosting Retreats

A business coach who hosts retreats in different cities books accommodations, transportation, and event services on the card. This racks up points quickly and supports additional logistics like speaker travel or venue upgrades at a lower net cost.

How Technology Enhances the Experience

Modern business travel rewards cards are backed by mobile apps and digital platforms that make the experience smoother and more data-driven.

Mobile App Control

Card issuers provide secure mobile apps where business owners can view transactions, redeem rewards, freeze cards, or monitor spending in real-time. This level of control is crucial for solo entrepreneurs or small teams managing rapid travel.

Some apps even push alerts for large or suspicious transactions, helping protect against fraud while on the go.

Virtual Cards and Employee Access

Many issuers allow businesses to issue virtual cards to employees for specific purposes. For example, a marketing manager attending a conference can be given a card with limits. The transactions flow into the dashboard and support streamlined reconciliation.

This kind of control makes team-based travel less risky and more efficient.

Practical Advantages in Business Travel

Beyond points and miles, this card supports operational goals.

Easier Budget Allocation

With clear visibility into travel spend and rewards return, business owners can better plan for future travel. Knowing what each trip costs net of rewards improves forecasting.

Points redeemed for flights or lodging allow those savings to be redirected into product development or team-building.

Boosted Employee Satisfaction

Providing team members with perks like lounge access, hotel upgrades, or meal reimbursements creates a better work experience. Happier employees perform better and represent the brand more positively when traveling.

Enhanced Brand Image

Using rewards to access higher-end accommodations or flight upgrades improves a company’s presence at events, investor meetings, or client pitches. This can contribute to new business, strategic partnerships, or press opportunities.

Problems Solved by Business Advantage Travel Rewards

High Travel Costs

By using the card for travel-related purchases, business owners accumulate rewards that reduce future travel costs. This alleviates pressure on cash flow and helps companies travel more often without increasing the budget.

Complex Expense Reporting

Manually managing receipts and reimbursements creates friction. With digital tracking and automated reporting, this card simplifies recordkeeping, especially during tax season or internal audits.

Missed Reward Opportunities

Many small businesses overlook the opportunity to earn rewards simply because they use non-optimized cards. Switching to a travel-focused card ensures every expense generates value.

FAQ

Q1: Does this card require excellent credit to apply?

Most travel rewards business cards require good to excellent credit, usually a score above 700. However, approval also depends on business revenue and history.

Q2: Can points be transferred to travel partners?

Some cards allow point transfers to airline or hotel partners. This varies by issuer. Cards affiliated with major travel networks typically offer this option for greater value.

Q3: What happens to rewards if the card is closed?

Rewards are often forfeited if not redeemed before account closure. It’s best to use or transfer points before cancellation to avoid loss.