Best 0 APR Credit Cards for Travel A 2025 Guide to Interest-Free Rewards

For frequent travelers and savvy spenders, finding the right balance between earning rewards and managing costs is essential. One of the most sought-after features of a travel credit card is an introductory 0% APR period. This benefit can help cardholders finance big trips or business travel expenses without worrying about interest charges at least for a limited time. In this article, we explore the best 0 APR credit cards for travel in 2025, how they work, and who benefits the most from using them.

What Is a 0 APR Travel Credit Card?

A 0 APR travel credit card is a credit card that offers an introductory 0% annual percentage rate (APR) on purchases, balance transfers, or both. This means you won’t be charged interest for a set period, typically ranging from 12 to 18 months.

In addition to this interest-free period, these cards are designed to reward users with points, miles, or cashback specifically for travel-related spending. The combination of no interest and travel rewards makes these cards powerful tools for financing and planning trips.

Who Should Consider a 0 APR Travel Card?

These cards are ideal for:

- New travelers planning a large upcoming trip

- Business owners or employees traveling for work

- Frequent flyers looking to manage travel expenses over time

- Cardholders seeking to consolidate high-interest debt while still earning rewards

If you’re someone who can pay off the balance before the promotional period ends, these cards provide real savings and benefits.

Key Features to Look For

Length of 0% APR Period

The longer the 0% APR period, the more flexibility you’ll have in repaying purchases. Some cards offer 12 months, while others go up to 21 months. Make sure you know exactly when the interest-free window ends and what the regular APR will be after.

Travel Rewards Program

While some 0 APR cards focus on balance transfers or general cashback, others are part of robust travel ecosystems. Look for cards that reward airfare, hotel, rideshare, and dining purchases with higher point multipliers or exclusive perks.

No Foreign Transaction Fees

Travelers who go abroad should always choose cards that waive foreign transaction fees. A 0% APR card with international support ensures you don’t get hit with 3% surcharges while spending overseas.

Redemption Flexibility

You’ll want a card that offers flexible ways to redeem points for flights, hotel stays, gift cards, or even statement credits. Some cards also allow point transfers to airline or hotel loyalty programs for extra value.

Top 0 APR Credit Cards for Travel in 2025

1. Chase Freedom Unlimited®

The Chase Freedom Unlimited offers a solid intro 0% APR on purchases for 15 months. While traditionally a cashback card, it integrates well with Chase Ultimate Rewards® for travel redemptions. Cardholders earn 5% on travel booked through Chase, making it a flexible choice for mixed spenders.

The card has no annual fee and is great for people who want to test the waters with travel rewards without locking into a premium product.

2. Wells Fargo Autograph℠ Card

This card offers 0% APR for 12 months and rewards for travel, transit, and streaming services. It earns 3x points on common travel categories and has no foreign transaction fees.

The Wells Fargo Rewards program allows for various redemption methods, and the card includes cell phone protection useful for on-the-go travelers who rely on their devices.

3. Citi Custom Cash℠ Card

Although it’s categorized as a cashback card, Citi Custom Cash earns 5% on your top spending category each billing cycle—including travel if it’s your highest expense that month. It features a 0% APR on purchases and balance transfers for 15 months.

Its flexibility makes it suitable for travelers with varied spending patterns who don’t always book large purchases but want ongoing value.

4. U.S. Bank Altitude® Go Visa Signature® Card

Offering 0% APR on purchases for 12 months, this card also earns strong rewards on travel, dining, and streaming. With no annual fee, it’s a practical choice for occasional travelers who still want to earn rewards and avoid interest on major expenses.

Its Altitude Rewards Center gives redemption options for travel, gift cards, and merchandise.

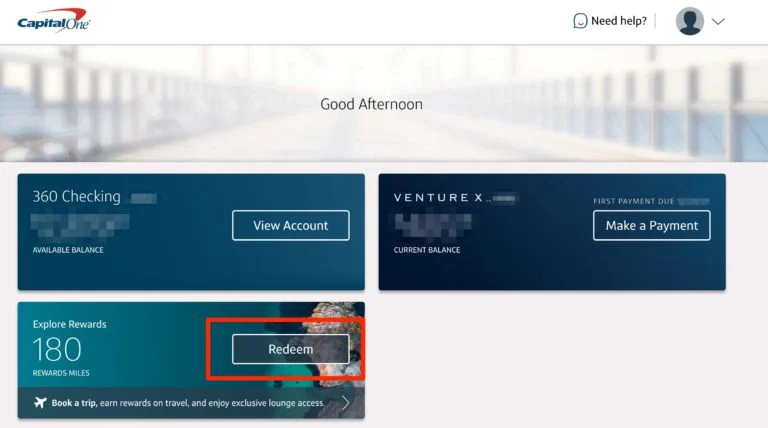

5. Capital One SavorOne Rewards for Good Credit

For travelers with good (not excellent) credit, this card offers 0% APR for 15 months and 3% back on travel, dining, and entertainment. It also waives foreign transaction fees, which is impressive for a no-annual-fee card.

The travel benefits integrate into Capital One’s rewards ecosystem, which allows redemption for flights, hotels, and more.

Technology Benefits of These Cards

Mobile App Controls

Every card issuer on this list provides a comprehensive mobile app. These apps offer transaction tracking, rewards management, fraud alerts, and card freezing tools. You can plan trips, manage expenses, and redeem points all in one place.

This digital convenience is crucial for travelers who are constantly on the move and need instant access to account information.

Virtual Cards and Travel Wallets

Most cards allow for virtual card numbers that can be used via digital wallets like Apple Pay or Google Pay. This not only boosts security but also adds flexibility during international travel.

These cards also sync with travel wallet apps that help keep track of itineraries, expenses, and documentation securely.

Practical Use Cases and Real-Life Benefits

Financing a Honeymoon

A newlywed couple uses a 0% APR travel card to book flights and hotels without dipping into savings. They plan to pay it off over 12 months interest-free, while also redeeming points earned on airfare for a future vacation.

This approach combines smart financing with strategic reward collection.

Managing Startup Travel Costs

A new business founder attending conferences in different cities uses a 0 APR card to book tickets and hotels. Since the card offers 15 months interest-free, the founder can build cash flow while traveling and collecting rewards for future business travel.

This is a lifeline for startups without big budgets but needing mobility.

Consolidating High-Interest Debt

A frequent traveler with existing credit card debt transfers the balance to a 0 APR card and makes new travel purchases. They pay off the balance within the promo period while still earning points, transforming debt payoff into a reward opportunity.

This strategy saves money and boosts the value of travel spend.

Why These Cards Solve Real Problems

Rising Travel Costs

With airfare and hotel prices on the rise, financing trips without interest can help maintain travel schedules. The rewards offset some of these costs through future redemptions.

Lack of Flexibility in Travel Redemptions

Many traditional travel cards lock users into specific airlines or hotel brands. These 0 APR cards offer broader redemption options and often connect with major travel portals.

Credit Card Interest on Large Purchases

Instead of paying interest on thousands of dollars in travel, these cards offer a 0% grace period. With disciplined payments, users can avoid interest entirely.

FAQ

Q1: What happens after the 0 APR period ends?

After the promotional period, the regular APR (often between 17%-27%) kicks in. It’s crucial to pay off the balance before this to avoid interest charges.

Q2: Do these cards come with annual fees?

Most of the cards listed have no annual fee. However, always check the terms, as some promotional offers change annually.

Q3: Can I qualify with fair or average credit?

Some 0 APR cards require good to excellent credit, but options like Capital One SavorOne may be available to those with fair or improving credit scores.