Bank of America Business Travel Solutions 2025 Insight Guide

Bank of America, one of the largest financial institutions in the United States, offers a range of services tailored for business travelers. From corporate cards and digital banking tools to tailored financial insights and travel-related perks, Bank of America provides robust support for businesses with frequent travel needs. In this article, we explore how Bank of America helps businesses manage and maximize their travel operations in 2025.

What Is Bank of America Business Travel?

Bank of America business travel refers to the suite of financial tools, rewards programs, and credit card solutions the bank provides for businesses that frequently engage in travel. These include the Business Advantage Travel Rewards Card, corporate expense management tools, and integrations that support both small and mid-size businesses.

This infrastructure allows companies to monitor, budget, and control travel expenses while also earning rewards or accessing discounts, depending on their chosen financial product.

Business Advantage Travel Rewards: Core Offering

At the heart of Bank of America’s business travel portfolio is the Business Advantage Travel Rewards Card. Tailored to business owners, this card offers rewards on travel purchases, along with perks like no foreign transaction fees and robust mobile banking capabilities.

Business owners earn unlimited points on travel and dining purchases, which can be redeemed for future travel or as a statement credit. The card integrates into the larger Bank of America ecosystem, allowing real-time access to spending analytics and expense management tools.

Features That Support Travel-Intensive Businesses

Real-Time Expense Monitoring

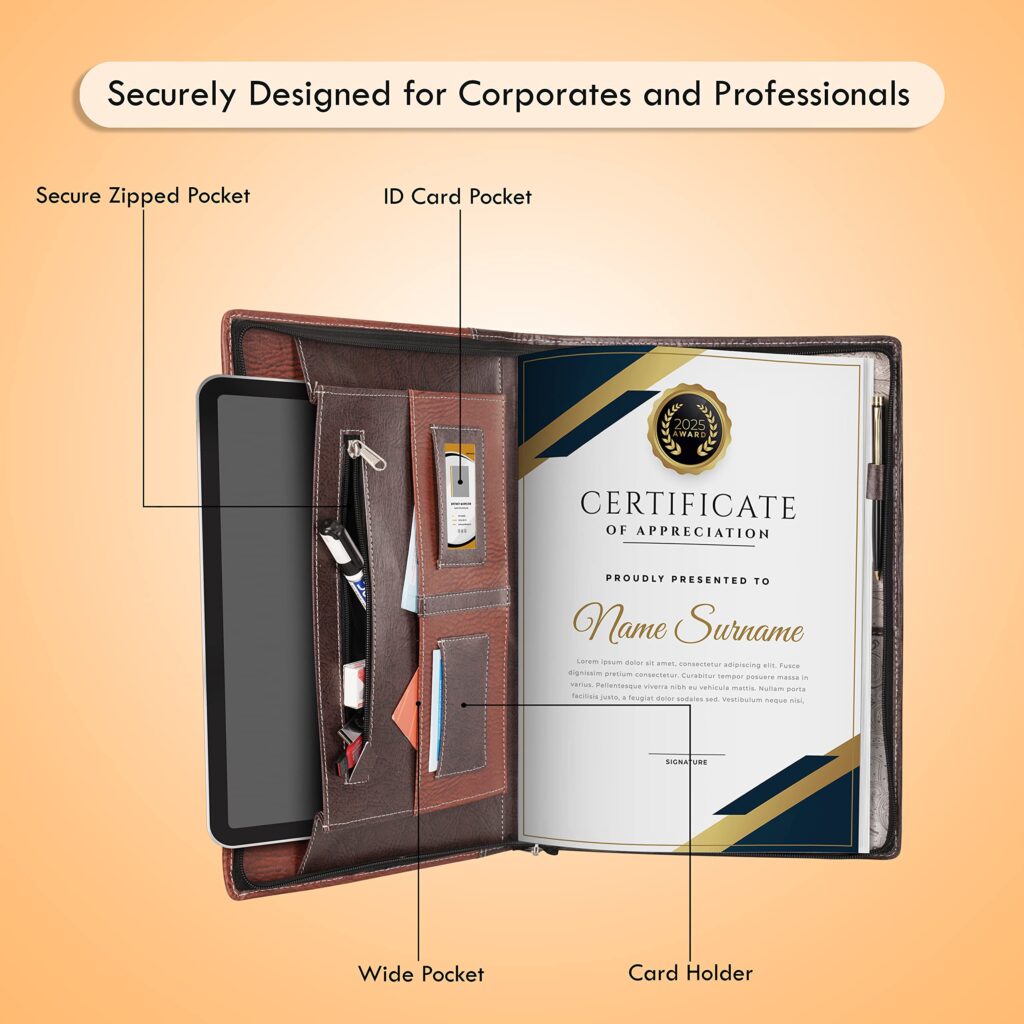

One of the core technological strengths of Bank of America’s business travel offerings is the ability to monitor expenses in real-time through the mobile app or desktop portal. Business owners and finance teams can view transactions categorized by employee, merchant, or trip purpose.

This level of detail enables better forecasting, minimizes surprise costs, and simplifies reporting during audits or quarterly reviews.

Flexible Redemption Options

The Business Advantage Travel Rewards Card doesn’t tie users to a specific airline or hotel chain. Instead, points can be redeemed across a wide variety of travel partners. This flexibility is key for businesses that travel to multiple regions or work with different vendors across industries.

This multi-brand compatibility ensures that earned rewards are more usable and easier to manage.

Real-World Examples of Bank of America Business Travel Use Cases

1. A Tech Startup Expanding Across States

A California-based tech startup expanding into Texas and Florida uses the Business Advantage card to book team flights, hotel stays, and rideshares. With integrated mobile alerts, the CFO tracks expenditures in real time and receives categorized reports by department.

The startup redeems rewards for future onboarding trips, reducing the need for additional travel budgets.

2. A Boutique Law Firm Meeting Regional Clients

A law firm handling cases in multiple cities uses the Bank of America card to pay for train tickets, business dinners, and lodging. Points earned are used for future team strategy retreats, while expense reports generated through the dashboard simplify billing and compliance.

Having access to fraud alerts and travel-specific protections also adds peace of mind when traveling for sensitive cases.

3. A National Sales Team on the Move

A product distribution company with a mobile sales force equips each rep with a virtual Business Advantage card. Spending limits are preset and linked to their department budget. Real-time tracking helps reduce overspending, and bonus rewards on dining and travel maximize return on sales trips.

These rewards are pooled at the corporate level and later reinvested into training events and industry expos.

4. A Creative Agency Attending Global Conferences

An agency specializing in international branding frequently travels to Europe and Asia. With no foreign transaction fees and access to multilingual mobile support, the team navigates travel easily. Earned points are redeemed for flights and accommodations.

The agency also uses the card’s analytics to benchmark marketing spend versus lead conversion per region.

5. An Educational Consultant Coordinating Workshops

An independent consultant hosting educational workshops across the country uses the Bank of America card to streamline costs. She tracks travel, lodging, and client meals through the portal, and automatically exports categorized reports to her accounting software.

Points are used for future hotel stays during slower seasons, helping stabilize cash flow year-round.

Benefits of Using Technology with Bank of America Travel Tools

Digital Security and Alerts

With 24/7 fraud monitoring, mobile push notifications, and instant card-lock capabilities, Bank of America ensures business travelers are protected against unauthorized charges. This gives peace of mind to teams handling confidential transactions while abroad.

Alerts also help stay within corporate budgets, especially when limits are set for specific departments or project types.

Integration with Accounting and ERP Tools

Bank of America supports seamless integrations with platforms like QuickBooks, Xero, and NetSuite. This reduces manual data entry and helps automate recurring tasks such as categorizing travel expenses, applying reimbursements, or allocating budgets across campaigns.

Practical Advantages in Real-World Travel Scenarios

Improved Budget Accuracy

Being able to track every transaction by employee, region, or project allows businesses to optimize how funds are used during business travel.

Misreporting or overspending is significantly reduced with real-time transparency.

Smarter Planning and Forecasting

Rewards redemption data, historical reports, and real-time balances all support better forecasting. Finance teams can predict how much of future travel will be offset by rewards and adjust spend accordingly.

Enhanced Employee Performance

Offering employees reliable travel tools that also reward their work motivates performance. Team members appreciate perks like smooth mobile payments, 24/7 customer support, and the flexibility of redeeming points for premium upgrades.

Use Cases Where Bank of America Business Travel Solutions Solve Problems

Decentralized Travel Spend

Solution: Centralizing purchases on a single card program reduces scattered receipts, missed reimbursements, and budgeting errors.

International Transaction Fees

Solution: The Business Advantage Travel Rewards card offers no foreign transaction fees, saving companies thousands over a fiscal year.

Lack of Visibility Across Departments

Solution: Real-time dashboards and categorized statements offer transparency into how, where, and why funds are being spent.

FAQ

Q1: Is the Bank of America Business Advantage Travel Rewards Card suitable for international travel?

Yes. It has no foreign transaction fees and includes protections for global purchases, making it ideal for international business travel.

Q2: Can I manage multiple employee cards from one account?

Yes. Business owners can assign virtual or physical cards to employees with preset limits and monitor each card’s usage in real time

Q3: Are rewards transferable to airline or hotel loyalty programs?

Bank of America points are typically redeemed through its rewards portal, which offers flexible travel options. Some transfers may be available, depending on promotional offers.