Best Business Travel Rewards Card Maximize Every Mile and Expense

Traveling for business isn’t just about packing your carry-on and hopping on a flight. It’s also a golden opportunity to earn rewards, optimize your spending, and unlock benefits that can make every trip smoother and more affordable. That’s where a business travel rewards card comes in a financial tool designed to turn expenses into travel advantages.

Whether you’re a frequent flyer or an occasional traveler handling client meetings across cities, understanding how these cards work can give your business a real edge.

What Is a Business Travel Rewards Card?

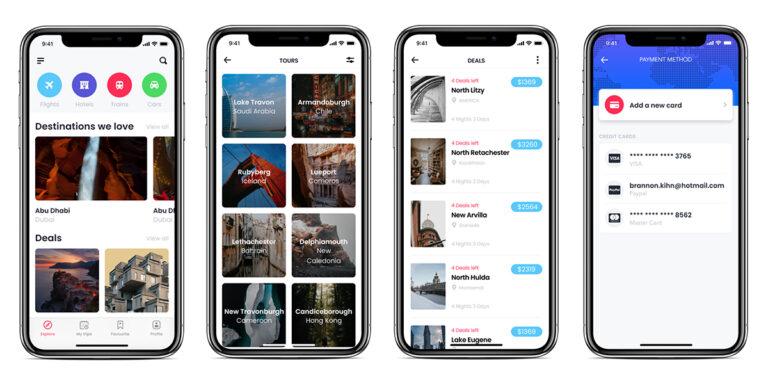

A business travel rewards card is a credit card specifically tailored for business owners and professionals who travel frequently. These cards offer points or miles for purchases especially those related to travel like airfare, hotels, car rentals, and dining.

In contrast to personal travel cards, business versions often include features like higher credit limits, expense tracking tools, employee card options, and exclusive business-related travel perks.

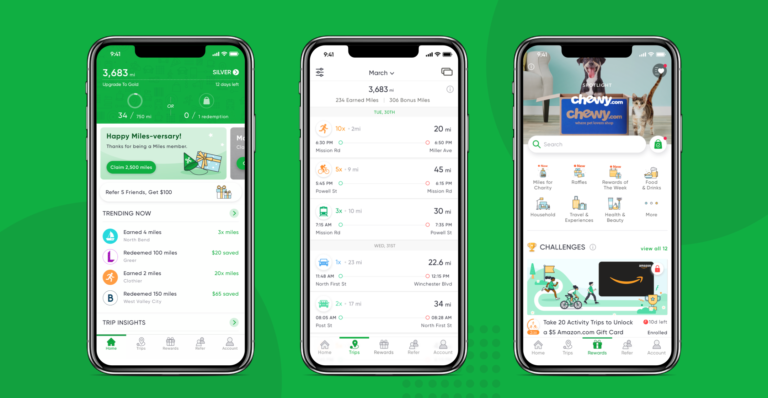

The rewards you earn can then be redeemed for future travel, gift cards, upgrades, or even statement credits, depending on the issuer.

Key Benefits of Using a Business Travel Rewards Card

There are several practical benefits to using these cards, especially when integrated into a company’s expense strategy. Below are some of the major advantages:

Earn Travel Rewards on Every Business Expense

Every hotel night, rental car, business lunch, or conference fee becomes an opportunity to earn rewards. The points or miles earned can later be redeemed to cut down the cost of future trips or reinvest into the business.

For example, if your team often flies for regional sales meetings, a rewards card could easily save hundreds or even thousands annually just from routine spending.

Access to Premium Perks

Many cards come with access to premium travel benefits. Think airport lounge access, priority boarding, free checked bags, and even travel insurance.

These perks may seem minor, but over time they improve the travel experience, reduce stress, and can make a big difference when flights are delayed or plans change unexpectedly.

Simplified Expense Management

Business travel cards typically come with built-in expense tracking and reporting tools. These tools help separate personal from business spending, categorize transactions, and streamline bookkeeping, saving time during tax season or audits.

Fraud Protection and Security

Most top-tier business travel cards offer fraud alerts, zero-liability protection, and even virtual card numbers. These features help safeguard your financial operations, especially when employees are using cards on the road.

Real-World Examples of Top Business Travel Rewards Cards

Here are some leading options in the business travel rewards world. These cards have earned top reviews from frequent business travelers and financial experts.

American Express Business Platinum Card

This card is often considered the gold standard for business travelers. It comes with a high annual fee, but it’s loaded with perks designed to offset that cost if used strategically.

-

Reward Potential: Earn 5x points on flights and prepaid hotels booked through Amex Travel.

-

Perks: Airport lounge access (including Centurion Lounges), hotel elite status, and a global concierge service.

-

Use Case: A consulting firm that sends employees across the country can save thousands in lounge access alone, not to mention elevated client experiences with hotel upgrades.

Chase Ink Business Preferred

A more budget-conscious but powerful alternative, this card is ideal for businesses that want a flexible points system and strong travel benefits.

-

Reward Potential: Earn 3x points on the first $150,000 spent annually on travel, shipping, advertising, and more.

-

Perks: Built-in travel insurance, no foreign transaction fees, and high point redemption value through Chase Ultimate Rewards.

-

Use Case: Perfect for remote agencies or small businesses doing digital advertising and occasional travel.

Capital One Spark Miles for Business

This card offers a simple rewards structure, making it a favorite for small business owners who prefer straightforward point earning.

-

Reward Potential: Earn unlimited 2x miles on every purchase.

-

Perks: Global Entry or TSA PreCheck credit, and flexible redemption options.

-

Use Case: A solo entrepreneur who juggles multiple roles and travels occasionally can still accumulate meaningful rewards with minimal effort.

Brex Card for Startups

Unlike traditional cards, Brex doesn’t require a personal credit check. It’s tailored to startups and tech-forward businesses.

-

Reward Potential: Earn up to 7x points on rideshare and travel-related categories.

-

Perks: No personal guarantee, expense tracking, and integrations with QuickBooks or Xero.

-

Use Case: A growing tech startup with a distributed team and frequent conference visits can gain serious value, especially by issuing cards to employees.

U.S. Bank Business Leverage Visa Signature

This card auto-adjusts to your highest spending category, ideal for companies with dynamic expense patterns.

-

Reward Potential: 2x points in the other top two categories (auto-determined), 1x on the rest.

-

Perks: $0 intro annual fee in year one, cell phone protection.

-

Use Case: A mid-size logistics firm with unpredictable travel routes and variable purchases could maximize points without complex tracking.

Practical Benefits in Real-Life Situations

Now let’s explore the real value these cards bring to day-to-day operations.

Reduce Out-of-Pocket Travel Costs

Using a rewards card means business travel doesn’t always have to come out of cash flow. Points and miles help offset flights, hotels, and even in-flight Wi-Fi. For startups or freelancers with tight budgets, this flexibility is essential.

Improve Employee Morale and Client Impressions

Imagine sending your top salesperson to a pitch meeting with access to airport lounges, priority seating, and a suite upgrade. It not only boosts morale but also subtly enhances your company’s image.

Even small businesses can play in the same field as large firms by leveraging card perks to enhance the travel experience.

Emergency Coverage and Peace of Mind

Most business travel rewards cards offer built-in protections like:

-

Trip cancellation/interruption insurance

-

Rental car insurance

-

Lost luggage reimbursement

These services are invaluable when travel plans go awry, allowing businesses to maintain professional commitments without worrying about lost expenses.

Common Use Cases for Business Travel Rewards Cards

Here’s how businesses are using these cards in the real world:

1. Monthly Client Visits Across Cities

A marketing agency might have contracts with clients in several cities. Instead of managing flights, taxis, and meals manually, the agency assigns employee cards to its consultants. Every expense earns rewards, and every trip becomes smoother with travel perks.

2. Attending Trade Shows and Conferences

Trade shows are expensive, from registration to hotel stays. A business card helps spread the cost over time, earns rewards, and adds protections like coverage for event cancellations or lost baggage.

3. Remote Teams Needing Frequent Travel

Distributed teams often require occasional travel to sync in person. Using a business card streamlines expense reports, while also earning points to offset future trips.

4. Managing International Travel for Product Sourcing

A small e-commerce business traveling to source products overseas can earn double or triple miles, avoid foreign transaction fees, and access travel insurance, all from a single card.

5. Handling Business Entertaining and Meals

Client dinners, prospecting lunches, or partner meetings, these expenses can stack up. With a rewards card, they not only build relationships but also generate points and perks.

FAQ

Q1: Can small businesses benefit from a business travel rewards card even if they don’t travel frequently?

Absolutely. Even infrequent travel still brings value through rewards, travel protections, and expense management tools. Cards like Capital One Spark Miles or Chase Ink are excellent for occasional travelers.

Q2: Are the rewards taxable?

In most cases, points or miles earned through business spending are not considered taxable income. However, any cashback received could be considered a rebate on purchases, so always consult your tax advisor.

Q3: How do I choose the right business travel rewards card for my company?

Start by evaluating your business’s travel frequency, spending categories, and team size. Then compare reward structures, perks, annual fees, and support tools. Focus on cards that align with your real-world operations, not just headline rewards.