Credit Card No Interest Airline Miles How to Fly Now and Pay Later Without Extra Cost

The idea of earning airline miles while paying no interest is more than just appealing it’s a smart financial strategy. Travel rewards credit cards with 0% APR give you the flexibility to pay off large expenses while still racking up valuable points or miles for future trips. In 2025, more consumers are seeking the sweet spot between interest-free financing and travel perks. This article explores the top features, benefits, and use cases for credit cards that combine zero interest and airline mile rewards.

Understanding No Interest Travel Credit Cards

Credit cards offering 0% APR on purchases (and sometimes balance transfers) allow users to delay interest payments for a promotional period. This period typically lasts 12 to 18 months. For travelers, this feature is extremely useful it enables them to book flights, hotels, and activities now and pay over time, interest-free.

Now, pair this with airline miles, and you’ve got a powerful combination. With each purchase, you accumulate points that can be redeemed for flights, seat upgrades, or even hotel stays. For frequent flyers or business travelers, this means the journey pays for itself over time.

Key Features to Look For

Introductory 0% APR Period

A longer 0% APR duration allows greater flexibility in paying off travel expenses. Aim for cards with at least 15 months of no interest on purchases.

Airline Miles or Travel Points Earning System

Cards should reward every day and travel-specific purchases. Some offer higher miles for flight bookings, others for dining and transportation. Look for programs that align with your lifestyle.

Redemption Flexibility

Good cards allow you to redeem miles across multiple airlines or even transfer points to travel partners. This gives more value per mile earned.

No Foreign Transaction Fees

Ideal for international travelers, this feature avoids extra charges on purchases made abroad.

Additional Travel Benefits

Perks like trip delay insurance, baggage protection, airport lounge access, and concierge services can elevate your travel experience without added cost.

Real-World Examples of Top Cards in 2025

1. Capital One VentureOne Rewards Credit Card

Capital One’s VentureOne offers 0% APR for 15 months and 1.25x miles on every purchase. Benefits include:

- Transferable miles to over 15 travel partners

- No foreign transaction fees

- Travel accident insurance

It’s perfect for travelers who want a straightforward earning and redemption process.

2. Chase Freedom Unlimited® (paired with Chase Sapphire Preferred®)

Though not a direct airline miles card, Chase Freedom Unlimited earns 5% on travel booked via Chase Ultimate Rewards. Pair it with Sapphire Preferred to convert cashback into travel points.

- 0% APR for 15 months

- Flexible redemption via a travel portal

- Strong travel protections

This duo is ideal for those who want to maximize both interest savings and point value.

3. Wells Fargo Autograph℠ Card

This card offers:

- 0% APR for 12 months

- 3x points on travel, gas, transit, dining, and streaming

- No annual fee

Points can be used for flights, hotels, and even rideshares. A great pick for everyday spenders who travel frequently.

4. American Airlines AAdvantage® Platinum Select® Card

Often includes limited-time 0% APR offers, especially for balance transfers. Key benefits:

- Earn miles on American Airlines purchases

- Free first checked bag

- Preferred boarding

This is best suited for loyal AA flyers who want airline-specific benefits and regular travel.

5. Discover it® Miles

With 0% APR for 14 months and unlimited 1.5x miles on all purchases, it’s both simple and generous. Plus:

- No blackout dates for redemption

- Match bonus at the end of year one

- Redeem miles for travel credits

A reliable option for occasional travelers and first-time cardholders.

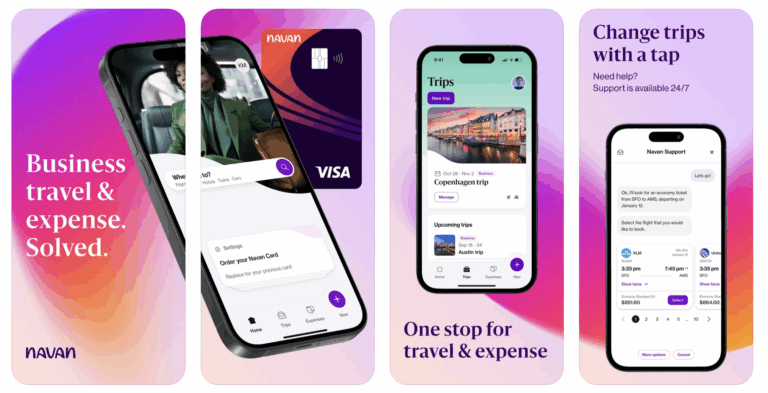

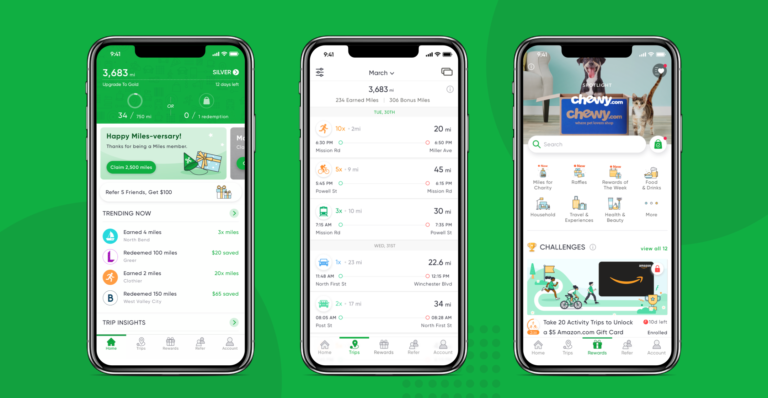

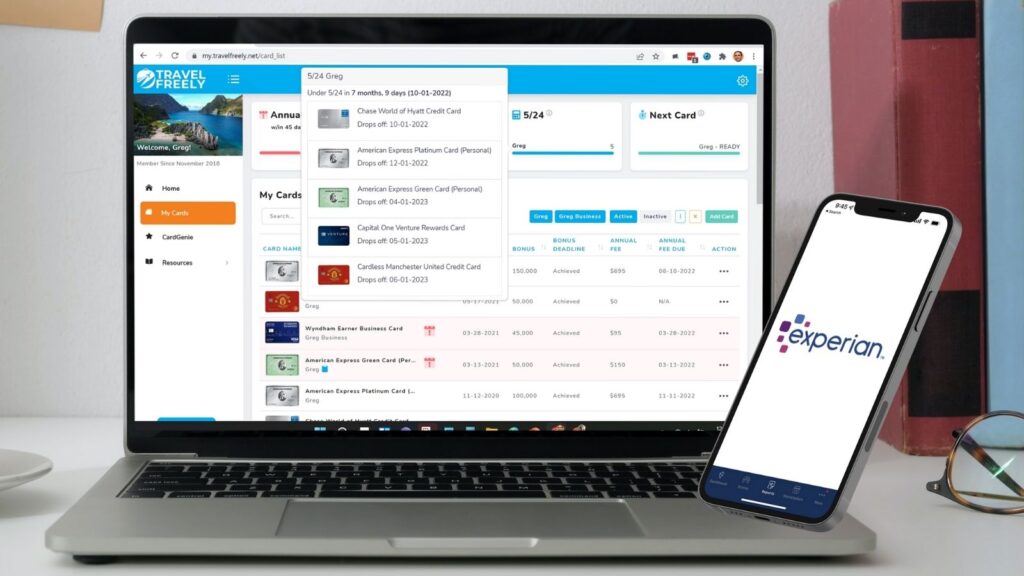

Technology and Credit Card Management for Travelers

Mobile Expense Tracking

Top credit card apps allow users to:

- View spending by category

- Track rewards progress

- Set travel alerts and manage security

This helps travelers stay on budget and avoid fraud during trips.

Virtual Cards for Secure Booking

Some issuers offer virtual card numbers for online purchases. This protects sensitive data when booking flights or hotels on new websites.

Seamless Travel Integration

Many cards integrate with airline and hotel apps, allowing:

- Direct reward booking

- Loyalty program syncing

- Alerts for mile expiration or travel deals

This adds convenience and value to every transaction.

Real-World Use Cases

Business Consultant with Frequent Flights

A consultant uses the Capital One VentureOne for frequent work trips. Flights, hotels, and meals earn miles. They pay off the balance interest-free within the 15 months, optimizing both cash flow and reward earnings.

Student Studying Abroad

A student going to Europe uses Discover it® Miles to cover flights and living expenses. They earn rewards on all purchases and enjoy 0% APR for 14 months, ideal for tight student budgets.

Family Planning a Vacation

A family uses the Wells Fargo Autograph card to book flights, hotel, and car rentals. By the time the promo APR ends, they’ve spread out payments comfortably and earned points to use on their next trip.

Benefits of Combining 0% APR with Airline Miles

Budget-Friendly Travel Planning

These cards allow for major trip bookings without immediate financial strain. You can plan without sacrificing quality or comfort.

Dual Value: Cash Flow + Rewards

You’re not just borrowing interest-free; you’re earning rewards simultaneously. It’s like getting paid to pay later.

Enhanced Travel Protections

From baggage delay reimbursement to travel accident insurance, many cards offer protections that save time and money when plans go awry.

Easy Access to Premium Perks

Some cards provide access to exclusive offers, early boarding, or upgrade options based on spending, further enhancing the experience.

Common Problems These Cards Help Solve

Problem: Upfront Travel Costs Are Too High

Solution: Book with a 0 APR card to avoid lump-sum payments, and pay over time while earning miles.

Problem: Not Earning Anything with Regular Credit Cards

Solution: Switch to a travel rewards card and turn every purchase of groceries, bills, and gas into flight miles.

Problem: Security Concerns While Traveling

Solution: Virtual cards, mobile app locks, and transaction alerts keep your finances protected.

FAQ

Q1: Do I still earn airline miles during the 0 APR period?

Yes. The interest-free status only affects how you pay your bill; it doesn’t stop miles or points accumulation.

Q2: Can I get a 0 APR airline miles card with average credit?

Most top-tier cards require good to excellent credit, but a few (like Discover it® Miles) are more flexible.

Q3: What happens if I don’t pay off the balance before 0 APR ends?

Any remaining balance will begin to accrue interest at the standard variable rate. Set reminders to pay off in time.