United Explorer MileagePlus Elevate Your Travel Rewards with United Airlines in 2025

The United Explorer MileagePlus Card is a co-branded airline rewards credit card issued by Chase in partnership with United Airlines. It’s designed for travelers who fly United frequently and want to accumulate MileagePlus miles through everyday spending.

The card offers benefits that extend well beyond earning miles. From free checked bags and priority boarding to access to United Club lounges (with passes), it serves as a practical tool for elevating the travel experience.

How the Card Works for MileagePlus Members

Earn United MileagePlus Miles on Daily Purchases

Cardholders earn miles for every dollar spent, especially on United purchases, dining, hotels, and eligible travel services. There are often large welcome bonus offers when cardholders meet minimum spending requirements within the first few months of opening the account.

The card also partners with the MileagePlus Shopping and Dining programs, letting members rack up miles by shopping through United’s online portal or dining at participating restaurants.

Use Miles for Award Travel, Upgrades, and More

Miles earned through the Explorer card can be redeemed for United flights, seat upgrades, hotel stays, rental cars, and more. Redemptions are particularly valuable when used for Saver Awards or MileagePlus Excursionist Perks, unique free one-way flights within a round-trip itinerary.

Cardholders may also receive access to more award seat inventory than non-cardholders, making it easier to book high-demand routes using miles.

Technology Enhancements and Travel Tools

Mobile Management and Travel Alerts

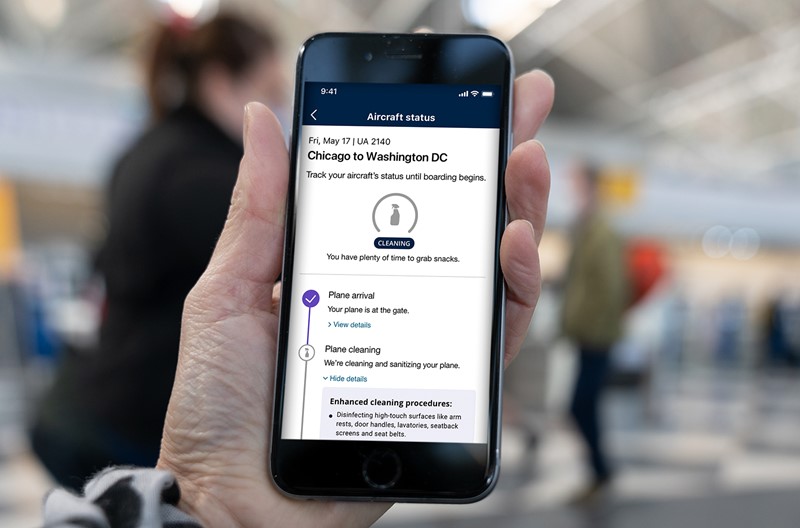

Cardholders can manage their rewards and travel directly through the United app and Chase’s mobile banking app. This integration helps travelers monitor reward progress, redeem miles, and stay informed about delays or gate changes.

Features like mobile boarding passes, real-time flight status, and mileage bonus notifications keep travelers connected and organized.

Contactless Payments and Digital Wallet Integration

The Explorer card works with Apple Pay, Google Pay, and other digital wallets. Cardholders benefit from contactless tap-to-pay, real-time transaction alerts, and advanced security features such as fraud protection and purchase monitoring.

Real-World Examples of Use

The Weekly Domestic Flyer

A consultant flying weekly from Chicago to New York earns miles on every ticket and expense related to the trip, including dining and hotels. Within a few months, miles are redeemed for seat upgrades, while the free checked bag and priority boarding streamline travel.

This setup reduces time at the airport and boosts comfort without extra cost.

Family Traveler on a Budget

A family of four uses the Explorer card for groceries, fuel, and entertainment throughout the year. The earned miles are then used for free flights during school holidays.

The card’s built-in travel protections and trip delay insurance provide peace of mind during every journey.

Occasional International Adventurer

A young traveler exploring Asia uses the card for hostels, transit, and meals. They redeem miles for one-way flights between major cities in the region. The Explorer card also offers two United Club one-time passes per year perfect for layovers on long international trips.

Key Cardholder Benefits

Priority Boarding and Free First Checked Bag

Explorer cardholders board earlier than general passengers and enjoy one free checked bag per United flight offering savings and convenience. These perks apply to the cardholder and one companion traveling on the same reservation.

Over time, these benefits easily offset the card’s annual fee.

United Club Lounge Passes and In-Flight Discounts

Each year, cardholders receive two one-time United Club passes, granting access to airport lounges. These lounges provide snacks, drinks, Wi-Fi, and a quiet place to recharge.

In-flight purchases also receive discounts on food, beverages, and Wi-Fi when paid for with the Explorer card.

Travel Insurance and Protection

The card offers a suite of protections including trip cancellation insurance, baggage delay reimbursement, rental car insurance, and lost luggage protection. This makes it especially useful for travelers frequently on the move.

Practical Benefits and Problem Solving

Smooth Business Travel

Business travelers who use the card for company expenses can accumulate miles that reduce their future travel costs. When paired with United’s Premier status tiers, it becomes even easier to access perks like complimentary upgrades.

Earning Miles Without Flying

Because the card earns miles on everyday purchases, even infrequent flyers can build up a solid MileagePlus balance over time. Using the MileagePlus Shopping and Dining portals further accelerates mileage accumulation.

Saving on Group Travel

Families or groups booking flights together benefit from the Explorer card’s free bag and boarding perks. These translate into tangible savings on checked baggage fees and help streamline the airport experience.

FAQ

Q1: Can the Explorer card help me earn Premier status?

No, but it can support mileage accumulation. Premier status still requires flight segments and dollars spent with United.

Q2: Do the United Club passes expire?

Yes, the two annual passes must be used by the expiration date printed on them.

Q3: Can I redeem miles for flights on airlines other than United?

Yes. United is part of Star Alliance, so you can redeem MileagePlus miles with partners like Lufthansa, ANA, and Air Canada.