Lufthansa Credit Card The Ultimate Guide to Earning Miles and Traveling Smarter in 2025

The Lufthansa Credit Card is a co-branded travel credit card tied to the Miles & More loyalty program. Issued in partnership with banks like Barclaycard (in the U.S. and Europe), it enables cardholders to earn Miles & More award miles through everyday purchases.

Unlike standard credit cards, it focuses on enhancing travel benefits for frequent flyers of Lufthansa and Star Alliance members. Whether you’re flying economy or business, it offers value through accelerated mile-earning potential, bonus miles, and priority travel perks.

How the Lufthansa Credit Card Works

Earning Miles Through Purchases

Cardholders typically earn 1–2 award miles per dollar (or euro) spent. Bonus categories may include travel, groceries, restaurants, or Lufthansa bookings directly. Most versions of the card offer sign-up bonuses that can be redeemed for flights or upgrades once a spending threshold is met.

In addition to flight spending, Miles & More partners like hotels, car rentals, and retail stores allow cardholders to grow their mileage balances faster. This helps travelers rack up points even when not in the air.

Redemption Options

Miles can be used for a wide range of rewards: flight tickets with Lufthansa or Star Alliance airlines, upgrades, extra baggage, airport lounges, and even merchandise. Lufthansa also regularly offers mileage sales and promotional redemption offers.

There are no blackout dates for award flights, and cardholders often get access to additional saver seat inventory. This flexibility ensures better planning and greater value per mile.

Tech-Driven Perks of the Lufthansa Credit Card

Seamless App Integration

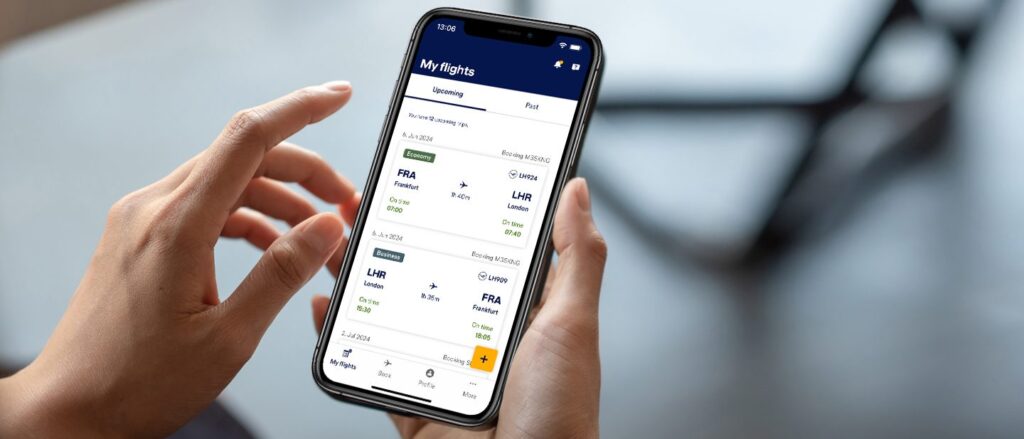

The Miles & More app allows users to track miles, receive promotional updates, and manage bookings. Credit card users can see their spending, benefits, and remaining balance in real time.

Additionally, mobile access enables you to book award flights, receive alerts for expiring miles, and unlock partner deals via the app. The app integrates with Lufthansa’s booking platform for frictionless travel planning.

Secure Payments and Digital Wallet Support

The Lufthansa Credit Card supports Apple Pay, Google Pay, and other mobile wallets. Features like biometric logins, transaction alerts, and chip technology help ensure user safety.

Cardholders also receive built-in security protections like fraud monitoring, travel insurance, and purchase protection on eligible transactions.

Lufthansa Credit Card in Real Life: Use Cases

European Business Travelers

A Munich-based executive flying weekly for regional meetings earns award miles on every ticket and expense. Within 6 months, he redeems miles for an upgrade to business class for a long-haul trip to Singapore.

He also uses fast-track security and lounge access included with his Frequent Traveller status, achieved in part through spending on his Lufthansa credit card.

Remote Professionals & Nomads

A Berlin-based freelance designer uses her Lufthansa Credit Card to pay for subscriptions, tech tools, and travel. Miles accumulates monthly, and she books award flights to Lisbon, Paris, and Prague without extra fees.

She appreciates the bonus miles, flexible redemptions, and the ability to use miles for hotel stays on spontaneous trips.

Family Vacation Planners

A family of four earns miles using their card for groceries, gas, and school expenses. Over a year, they accumulate enough miles for two award tickets to London.

They redeem additional miles for extra luggage and seat selection, creating a smoother family travel experience with reduced costs.

Benefits of the Lufthansa Credit Card

Better Flight Access and Upgrades

Cardholders can access additional award seat inventory, especially for Lufthansa-operated flights. They’re often prioritized for upgrades when using miles.

On top-tier cards, benefits may include two-for-one flight vouchers, complimentary checked bags, and upgrade vouchers. These perks significantly enhance the flying experience.

Accelerated Elite Status Progression

Spending on a Lufthansa Credit Card may contribute to elite status. Frequent Traveller, Senator, and HON Circle statuses each come with perks like lounge access, priority check-in, and upgrade rights.

Elite status also improves the availability of award redemptions and provides special booking channels.

Cost Efficiency and Travel Insurance

From trip delay coverage to rental car insurance and lost luggage reimbursement, Lufthansa cards often include comprehensive travel protections.

Combined with mile redemptions, these benefits reduce overall travel expenses, especially for frequent flyers.

Practical Use Cases for Maximizing Value

Booking Complex Itineraries

Cardholders can use miles for multi-city award flights across Europe, combining multiple destinations in one redemption. With no blackout dates, planning complex trips becomes easier.

Families and business travelers alike benefit from the flexibility in schedule and routing options.

Earning Miles Without Flying

Miles accrue even without stepping on a plane. Everyday purchases, hotel stays, and online shopping portals let users build balances year-round.

Special partner promotions and double-mile campaigns further boost the mileage potential.

Saving on Premium Travel

Rather than paying outright for business class, users combine fare deals with mile-based upgrades. This hybrid strategy stretches travel budgets while enhancing comfort.

Lounge access, fast boarding, and bonus baggage help create a premium experience even for leisure trips.

FAQ

Q1: Is the Lufthansa Credit Card only useful for Lufthansa flights? No. Since it’s part of the Miles & More program, you can redeem miles across Star Alliance airlines including Swiss, Austrian, United, and ANA.

Q2: Do Lufthansa miles expire? Yes, unless you are a Frequent Traveller or higher, or actively use your Lufthansa Credit Card. Regular card usage helps keep your miles valid.

Q3: Can I get elite status faster with a Lufthansa Credit Card? In some markets, yes. Certain cards contribute status miles or offer thresholds that help cardholders reach Frequent Traveller or Senator status sooner.