Best Small Business Credit Card for Travel Rewards in 2025

Running a small business means juggling expenses, managing operations, and planning ahead. If your business involves travel whether occasionally or frequently it’s smart to make those travel expenses work for you. A well-chosen small business credit card for travel rewards not only provides convenience but also turns routine spending into long-term value.

In 2025, there’s no shortage of great options. But choosing the best card requires knowing what to look for: rewards, benefits, protection, and flexibility.

What Makes a Credit Card the Best for Small Business Travel?

Small business credit cards are tailored for entrepreneurs, freelancers, and business owners who need to manage their company’s spending. When it comes to travel rewards, the best cards offer high point-earning potential, robust travel protections, and valuable perks that reduce out-of-pocket travel costs.

Unlike personal travel cards, business credit cards often include:

-

Employee card options

-

Expense tracking dashboards

-

Bonus categories aligned with business spending

-

Higher credit limits

-

Business-related travel protection

These features make them not only practical for operations but also strategic tools to grow your rewards portfolio.

Key Benefits of Using a Travel Rewards Card for Small Business

Travel rewards cards help maximize the return on essential business expenses. But beyond miles and points, they offer technological and operational advantages.

Streamlined Travel and Expense Management

Most business travel rewards cards integrate with accounting tools or provide dashboards that track spending across multiple categories. This makes it easier to reconcile travel costs at tax time or analyze trends.

They also offer virtual cards, alerts, and fraud protections crucial when multiple employees have access to company funds.

Access to Business-Focused Travel Perks

The best cards unlock access to airport lounges, travel insurance, TSA PreCheck credits, and elevated status with hotel or airline partners. These perks aren’t just luxuries; they improve productivity and reduce disruptions during business travel.

Real-World Examples: Top Small Business Credit Cards for Travel Rewards

Here are five standout business credit cards that have proven value for business travelers in 2025. Each offers a distinct combination of perks and rewards that cater to specific business needs.

American Express Business Platinum Card

This card is designed for companies that travel frequently and want elite-level perks. While the annual fee is high, the benefits can easily offset the cost.

-

Reward Potential: 5x points on flights and prepaid hotels booked through Amex Travel

-

Perks: Access to Centurion Lounges, airline incidental fee credits, and hotel elite status

-

Use Case: A consulting firm that books multiple flights monthly and values upscale travel experiences.

Chase Ink Business Preferred

This card balances strong travel rewards with an affordable annual fee. Its Ultimate Rewards points are versatile and can be transferred to top travel partners.

-

Reward Potential: 3x points on travel, shipping, and advertising (up to $150,000/year)

-

Perks: Primary rental car insurance, travel cancellation insurance, and no foreign transaction fees

-

Use Case: Digital marketing agency with regular team travel and international ad spending.

Capital One Spark Miles for Business

This card is known for its simplicity: 2x miles on every purchase with no categories to track. It also includes access to TSA PreCheck/Global Entry credits.

-

Reward Potential: Unlimited 2x miles on all business purchases

-

Perks: Flexible redemption, miles transfer to travel partners, and low annual fee

-

Use Case: Solo entrepreneur managing travel-heavy freelance projects with minimal admin effort

Brex Card

Brex offers a modern approach: no personal guarantee, instant approval for eligible startups, and integration with financial tools.

-

Reward Potential: Up to 7x points on travel, rideshare, and restaurants

-

Perks: No annual fee, software discounts, and automatic expense categorization

-

Use Case: Tech startup with remote teams and frequent travel to pitch investors

U.S. Bank Business Leverage Visa Signature

This card rewards your top two spending categories each month automatically, making it ideal for businesses with changing spending patterns.

-

Reward Potential: 2x points on your top two categories each billing cycle

-

Perks: Cell phone protection, introductory offers, and $0 intro annual fee for the first year

-

Use Case: A logistics company with diverse monthly travel and fuel expenses

Practical Advantages of Travel Rewards Cards for Business Owners

Choosing the right card goes beyond benefits; it should work with your business model and improve your day-to-day operations.

Better Cash Flow and Resource Allocation

With cards offering travel credits, discounts, or cashback, businesses can optimize their budgets while avoiding upfront costs. Delayed billing cycles give businesses more flexibility in managing cash.

Using points to book travel helps reduce expenses, allowing owners to reallocate funds into growth areas like marketing or hiring.

Improved Employee Productivity and Comfort

Providing employees with lounge access, fast-track security clearance, and automatic travel protections improves morale and reduces stress during work trips. This can lead to better performance during client meetings or trade shows.

Integrated Financial Oversight

Top cards often include digital tools for setting spending limits, flagging unusual activity, and exporting data directly to accounting software like QuickBooks or Xero. This reduces administrative burden and improves compliance.

Use Cases: How Businesses Solve Problems with Travel Rewards Cards

Let’s break down how travel rewards cards help solve real problems faced by small businesses:

1. Managing Employee Travel Without Overspending

A marketing agency frequently sends account managers to client cities. By issuing employee cards with set limits and alerts, they control costs and earn miles while simplifying expense reports.

2. Booking Travel in Unpredictable Industries

A construction consulting firm bids for contracts nationwide. The business often books last-minute travel. With a card offering price prediction tools and cancellation insurance, they save money and reduce risk.

3. Building Credit While Traveling for Growth

A new business trying to scale internationally uses a business card to earn rewards on travel while also building its credit profile. Over time, this supports better financing options and vendor trust.

4. Increasing Client Impressions Through Premium Travel

A boutique law firm uses a premium business card to book upgraded seats and hotel perks for client visits. This positions the firm as high-end and builds brand value through experience.

5. Simplifying Taxes and Annual Reporting

A creative agency uses a travel rewards card integrated with its tax software. Every travel expense is categorized instantly, reducing the year-end chaos and improving accuracy.

How Technology Enhances the Business Card Experience

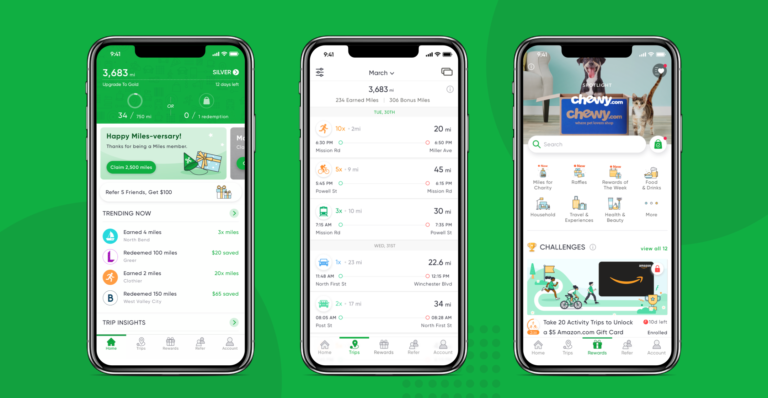

Mobile Apps and Portals for Real-Time Oversight

Most travel cards now offer robust apps that display real-time spending, manage employee cards, track rewards, and offer quick access to travel benefits. This is especially helpful for remote or fast-moving businesses.

Integration with Accounting and ERP Tools

Modern travel rewards cards sync with platforms like FreshBooks, QuickBooks, and NetSuite. Business owners can automate expense tracking, flag anomalies, and ensure clean recordkeeping.

These digital advantages are essential in 2025, where automation and accuracy define business efficiency.

FAQ

Q1: Can I get a small business credit card if I’m a freelancer or sole proprietor?

Yes. Most issuers accept applicants without a formal business entity. You can use your Social Security Number and report income from freelance or gig work.

Q2: Do business credit cards affect my credit score?

Some cards report to both personal and business credit bureaus. While responsible use helps both, late payments could affect your score if the issuer reports them.

Q3: What happens to rewards if I close the account?

Generally, rewards are forfeited if not redeemed before closing. It’s best to use or transfer rewards before account closure to avoid loss.